Alexander E. Braun, Senior Editor -- Semiconductor International, 8/20/2009

Optimism prevailed at the SEMI Silicon Valley Lunch Forum, where presenters said better times are on their way.

This year will experience a negative global GDP (-0.8%), which Bill McClean, president of IC Insights (Scottsdale, Ariz.), said is the worst performance since 1946 in the aftermath of a world war that devastated most of the planet's production centers. "To put things in perspective," he said, "since a global recession is defined as 2.5% growth or less, the situation is pretty bad."

The good news is that things are looking up. "In our forecasts we warned people to think quarterly, not to look at 2009 in total," McClean said. "The world GDP may be negative, but Germany has announced that it is out of the recession. They had growth in the second quarter, as did France and Japan. These countries were not expected to show a positive GDP until 2010. The U.S. will show growth in the 3Q09 GDP."

As a result, semiconductors are experiencing up to a 4% growth this quarter, and McClean said next year we can expect a 3.4% GDP. Meanwhile, the economists' forecasts for 2010 keep creeping upward. "The long-term average is 3.6%, so 3.4% is not that great, but it is a heck of a lot better than -0.8%."

Global recessions are nothing new; they have happened before. However, the current one has been steeper than most. "If we go by the past history of these cycles, after every global recession we have had two great years of semiconductor growth," McClean said. "We are looking at at least a 15% growth next year, probably over 20%. Global recessions are times of pent up demand; they do not crush or eliminate demand for electronic systems. As soon as things look better, companies and people start buying — new PCs, cell phones, new servers, TVs, and other appliances."

Worldwide, there are $2 trillion worth of stimulus packages. What not many people seem to realize is how the $2T is going to be spent. "The following numbers must be considered: 30, 60, 10," McClean said. This refers to the percent of the stimulus that will be spent in 2009, 2010 and 2011. Thus, 30% of this $2T will be spent this year, with most of the stimulus spending coming in during the course of 2010. This means that stimulus spending still has not really kicked in. But there already are positive GDPs in France, Germany and Japan now; China's is probably at 10% now — its stimulus package hit the road running and China is not far from being where it was before, at 11%. The bulk of the spending is yet to come, and it will run into 2011.

The only concerns lie in what direction oil prices and interest rates take. Although interest rates are not expected to slide upward in any major way worldwide during 2010, oil remains the global economy's wildcard. Oil prices are waiting for any sign of a recovery, and may take off to $80, $90 or more per barrel. This might slow down the recovery and is something that requires attention.

McClean reminded his audience that commercial electronics sales are seasonal, and that one should not concentrate so much on the disastrous sales statistics of the first half of the year. "Cell phones are a seasonal business — you always sell more of them during the second half of the year. PCs and the bulk of consumer electronics are seasonal as well. So there was the seasonal impact on sales during the first half, made more difficult by the global recession, which was at its worst, as well as a huge inventory adjustment. But that is over; better numbers are coming for the second half of 2009.

McClean predicts that for the second half of 2009 cell phone shipments will be up 18%; PC shipments up 15%; the IC market will be at $100B, up 19%; the IC foundry market will be at $9.9B, up 43%; and semiconductor capital spending will hit $15B, up 33%.

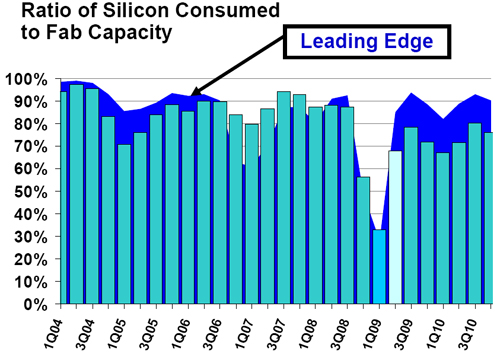

Dean Freeman, research vice president at Gartner (San Jose), said that foundry supply and demand trends indicate that the utilization rate will increase from 68% in 2Q09 to 78% in 3Q09. "This will be strongly driven by PC and baseband applications," he said, adding that he expects 45/40 nm technology to ramp up significantly in 2H09. "Capacity will increase by about 8% in both 2009 and 2010, while wafer shipments will drop by 14% before growing 26% in 2010." He also predicted a 74% annual utilization rate by 2010.

|

Foundry capacity utilization is expected to further increase from 68% in Q2 to 78% in Q3 2009. (Source: Gartner)

|