After dramatically reducing bloated inventories in 2009, global semiconductor suppliers are expected to keep lean stockpiles in the first quarter of 2010 to maintain profitability amid uncertain economic conditions, according to the latest research from iSuppli.

Alexander E. Braun, Senior Editor -- Semiconductor International, 1/6/2010

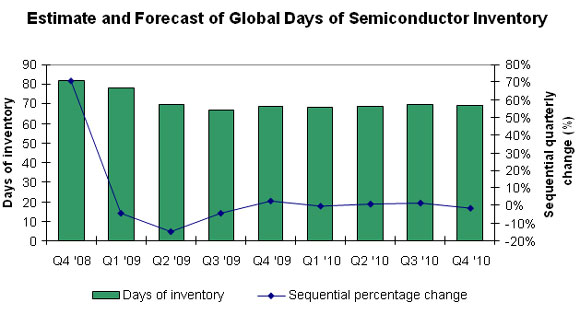

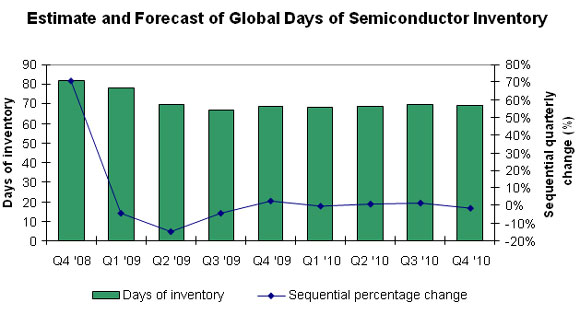

Days of inventory (DOI) among semiconductor suppliers are expected to decline to 68.3 at the end of the first quarter of 2010, down from 68.5 for the fourth quarter of 2009, according to market researcher iSuppli (El Segundo, Calif.). With DOI already 2.9% below the historical average in the fourth quarter, first-quarter inventories are expected to be 6.9% below the norm. While inventory in the first quarter is expected to remain at about equilibrium level with demand, stockpiles will be at very low levels, bordering on shortages for some specific devices.

"Despite a very poor 2009 for the semiconductor industry, chip suppliers managed their inventories deftly during the year, reducing DOI by 18.2% from the end of the fourth quarter of 2008 to the conclusion of the third quarter of 2009," said Carlo Ciriello, an iSuppli analyst. "With inventories having been brought down to equilibrium, these companies are expected to continue to manage stockpile levels expertly. The key for semiconductor suppliers in 2010 will be to capture revenue opportunities without double booking or overstocking. Those suppliers that successfully manage lead times and read the tea leaves of demand will reap the benefits of rising revenue and expanding market share."

Although the inventory level at the end of the fourth quarter of 2009 was less than the historical average, DOI among semiconductor suppliers actually rose slightly during the period, up 2.7% from 66.7 for the third quarter. "Most semiconductor suppliers in the fourth quarter engaged in inventory restocking efforts," Ciriello said. "However, these represent modest replenishments — and iSuppli does not detect any indications of an inventory snap-back to the inflated levels of 2008. The increase in inventory was needed to ensure adequate supply during the high-demand period in the fourth quarter driven by the Christmas selling season."

|

|

iSuppli's quarterly estimate and forecast of days of inventory among worldwide semiconductor suppliers shows inventory stabilizing throughout 2010, to ~70 days. (Source: iSuppli) |

Throughout 2010, DOI is expected to stabilize at close to the 70-day level. Semiconductor suppliers are set to keep inventory at equilibrium with demand during all four quarters of the year.

On a dollar basis, inventories are expected to rise moderately in the second, third and fourth quarters. However, these increases will be cautious as suppliers strive to maintain stable lead times and try to place upward pressure on average selling prices (ASPs) and margins. This continued tight management of inventories will help the semiconductor industry attain double-digit percentage growth in 2010. After a decline of 12.4% in 2009, worldwide semiconductor revenue is set to rise by 15.4% in 2010, iSuppli predicts.

While no widespread shortages are expected, there could be limited availability of NAND flash in 2010. However, this shortfall is expected mainly to be driven by strong demand. "If Apple Inc. even comes in close to its forecasted run rate, there will definitely be shortages of NAND flash in 2010," Ciriello warned.

Asked whether some of the much-expected high-semiconductor-content products, such as Apple's tablet, might cause an inventory shortfall, Ciriello indicated that it is still early to tell. "It is as yet uncertain what features the product will offer. I don't see it having much of an impact because it probably will not initially sell in numbers large enough to affect worldwide inventories." An industry observer agreed with Ciriello, adding that Apple generally has a very good idea of the magnitude of inventory it needs and would not be caught short. Its need for parts should not impact the supply chain.

Ciriello conceded that this — and just about every other forecast — could be thrown out of kilter if demand comes in much higher than anticipated. "That could throw a wrench into the whole system," he said. "For example, if Windows 7 suddenly takes off and the enterprises decide that they're going to update their PCs and networks and start buying, and consumers begin to purchase electronics as if the Great Recession had never happened, there could be some inventory strains. However, I would be very surprised if semi suppliers and the rest are unable to capture that revenue."

The analyst added that the Hewlett-Packards, Intels and Dells of this world usually have a very good idea of what is coming down the line. "It would be very surprising if they got caught with empty shelves," he said. "However, if demand considerably exceeds expectations, then the industry might begin double booking again and that would certainly have a negative impact on how things develop."

Although most forecasters' crystal balls tend to cloud if an attempt is made to look beyond a year, Ciriello said that if one assumes that governments here and around the world continue to pump money into the global economy, consumer spending picks up, and there is not any other massive shock to the economic system, although 2010 looks like a very good year for everyone in the supply chain, 2011 could be even better.