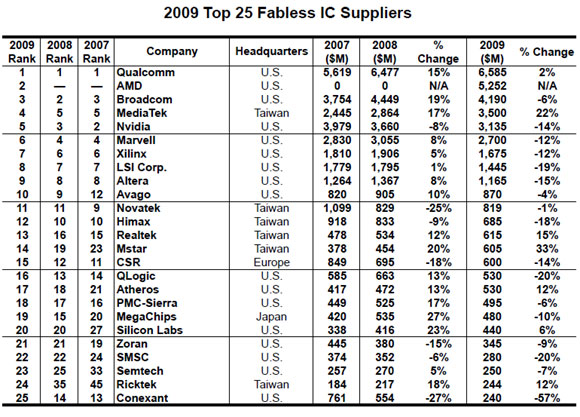

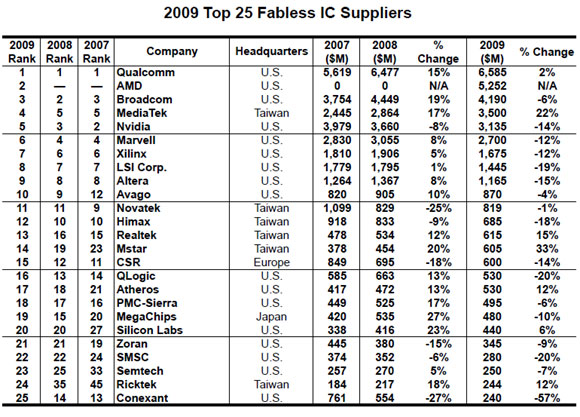

Fabless IC companies had a tough year in 2009, IC Insights reported, with only seven of the Top 25 showing revenue growth. Qualcomm, the largest fabless vendor, managed a 2% growth rate last year. AMD, which spun out its Dresden fabs early last year to GlobalFoundries, was counted as a fabless vendor for the first time.

Staff -- Semiconductor International, 1/19/2010

IC Insights Inc. reported that nine fabless IC companies had sales of $1B in 2009, led by Qualcomm Inc. (San Diego) and new entrant Advanced Micro Devices Inc. (AMD, Sunnyvale, Calif.), which spun its fabs into GlobalFoundries late in the first quarter of last year. MediaTek (Hsinchu, Taiwan) increased its sales by 22% to $3.5B to lead all fabless companies in terms of revenue growth.

|

|

Only seven of the 25 largest fabless IC companies enjoyed revenue growth last year. (Source: IC Insights Inc.) |

Qualcomm increased its sales by 2% in 2009 to ~$6.6B, a year in which the 10 largest fabless companies, excluding AMD, saw annual sales decline by 4%. The remainder of the top 25 fabless companies saw sales drop by 13% on average.

Bill McClean, president of IC Insights, said the top 10 share of total fabless company IC sales rose to 65% in 2009, up five points from 2007. "As the barriers to entry rise — such as high design costs and increasingly difficult access to venture capital money — it appears that the fabless IC supplier listing will continue to become more top-heavy in the future."

U.S.-based fabless companies continue to dominate, with 17 of the top 25 and nine out of the top 10 headquartered in the United States. "With only one Japanese company, MegaChips, in the ranking, it is obvious that the fabless/foundry business model has not significantly caught on in Japan," McClean said, adding that it is unlikely to do so in the near future. "However, as Taiwanese and Chinese IC design houses continue to advance, IC Insights expects an increasing number of Taiwan- and China-headquartered companies to eventually make the top-25 fabless supplier ranking."

Over the past decade (1999-2009), fabless IC companies had compound annual growth rates (CAGRs) of 15%, while the IDMs eked out 2% sales CAGRs on average. In 1999, fabless IC company sales accounted for just over 7% of the total IC market, while in in 2009, fabless IC suppliers (including AMD) represented 23% of worldwide IC sales. McClean said IC Insights forecasts that in 2014 fabless IC companies will command at least 27% of the market as more large companies become fabless, following a path taken by LSI Logic, Agere and AMD in recent years.